Posted on

September 5, 2025

by

Monica Romey

September 2025 Market Insight | By Monica

The Fraser Valley real estate market has entered a significant transition as we head into the fall season. For months, both buyers and sellers have been navigating a market shaped by economic uncertainty. Now, we’re beginning to see the effects of that uncertainty reflected in price adjustments, inventory stabilization, and shifting buyer behaviour.

In August 2025, home sales in the Fraser Valley dropped more than 20% compared to July, and 13% year-over-year. According to the Fraser Valley Real Estate Board (FVREB), just 931 homes sold on the MLS® last month—making August 36% below the 10-year average for sales. However, for strategic buyers, this cooling activity signals something important: opportunity.

Despite the decline in sales, the number of active listings held steady, with over 10,000 homes currently available across the region. While new listings declined by 19% from July, year-over-year inventory actually ticked up slightly—giving buyers a wider selection of properties without the urgency that once dominated the market.

The sales-to-active listings ratio dropped to 9%, well below the 12–20% range that defines a balanced market. This confirms what buyers and agents alike are experiencing on the ground: a true buyer’s market, where negotiations can be more favourable and conditions more flexible.

💰 Prices Have Softened Across All Property Types

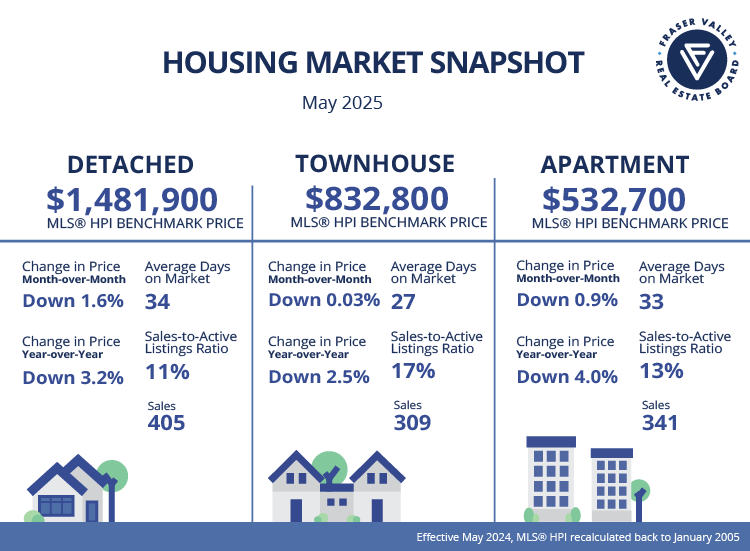

August also brought a modest but meaningful price correction. The composite Benchmark Price across the Fraser Valley dropped by 0.9% month-over-month to $936,200. This price easing is consistent across all housing types:

Detached homes: $1,436,800 (↓ 1.0% from July, ↓ 5.7% from Aug 2024)

Townhomes: $807,800 (↓ 0.9% from July, ↓ 4.5% from Aug 2024)

Apartments: $514,100 (↓ 1.0% from July, ↓ 5.9% from Aug 2024)

For buyers who have been holding out, this correction offers a lower entry point than we’ve seen in some time—particularly in desirable segments like detached homes and townhouses, which had previously surged beyond affordability for many.

⏳ Homes Are Taking Longer to Sell—And That’s Good News for Buyers

In addition to softer pricing and greater choice, the pace of the market has slowed. In August, the average time on market was:

This extended timeline gives buyers room to make informed decisions, complete proper due diligence, and negotiate on terms that support their goals—without fear of being outbid in hours.

The market is no longer in a state of frenzy—and that’s a good thing for serious, financially prepared buyers. As Baldev Gill, CEO of the FVREB, noted, the economic uncertainty of early 2025 has largely been factored into today’s market dynamics. What remains is an environment where buyers can re-enter with confidence and strategy.

While no one can predict the exact bottom of any market, smart buyers know that the best time to act is often when others are hesitant. With prices trending downward and inventory holding firm, this fall could represent a rare alignment of timing, value, and negotiation power.

🎯 Final Thought: The Market Is Whispering, Not Shouting—Are You Listening?

For those with a long-term outlook, this is a market to approach with clarity, not fear. It’s an ideal time for buyers to secure not just a property, but a smart investment backed by data and discernment.

If you're considering making a move or simply want personalized insight into what these changes mean for your goals, let’s connect. I’m here to provide honest, grounded guidance—driven by data, elevated by experience.

📩 Contact me today for a private consultation or a custom property report.